Jessica Brita-Segyde

The mortgage payment. It’s a sign of adulthood, so if you have one – good for you! If you’re in the market for one, get ready to experience a new kind of housing payment - one that actually contributes to your net worth instead of depleting it. Whether you’re just entering the realm of home ownership or you’re a seasoned pro, it benefits you to stay financially educated. Here’s a breakdown of where the money goes when you make your mortgage payment:

PITI

Principal – The principal is the dollar amount that you’re financing. For example, let’s say you buy a house for $200,000 with a 20% down payment. Your down payment would be $40,000, leaving $160,000 as your principal loan amount. Your lender will direct a portion of your payments toward the principal and that portion gradually increases with each payment you make.

Interest – Interest is what you pay to the lender in exchange for the risk they assume. The total interest you pay over the life of your loan depends on your interest rate, the length of your loan, and whether you pay extra on the principal (more on that later).

Taxes – Homeowners pay taxes to their city, county and municipal governments in exchange for services received. These services may include police, fire, schools, infrastructure, and other special projects. Your local assessor will send a notice, usually semi-annually, to let you know the assessed value of your home and the resulting tax bill. If you escrow your tax payment, as most people with a mortgage do, then your tax payment is included with your monthly mortgage payment.

Insurance – Homeowner’s Insurance is a requirement if you have a mortgage (and still highly recommended even if you don’t.) Again, most borrowers escrow this yearly premium, thereby making it a part of their monthly mortgage payment.

Amortization

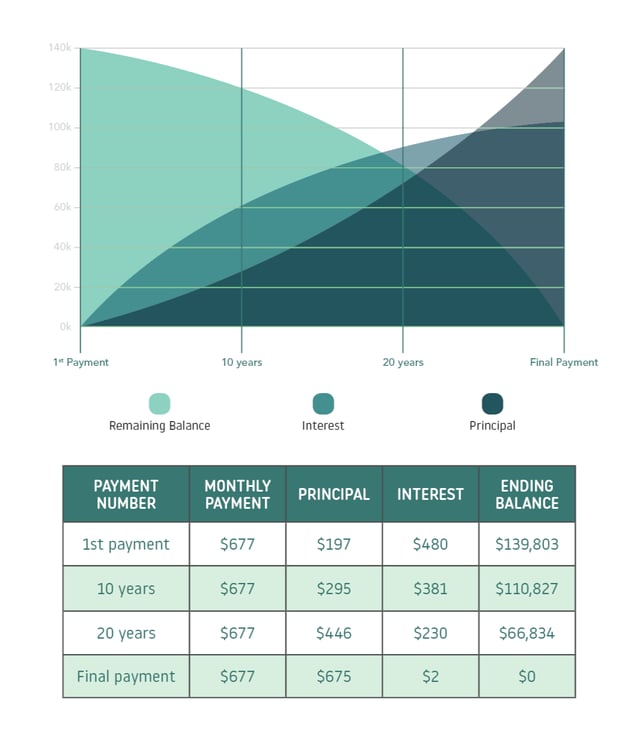

A loan with equal monthly payments, a fixed rate, and a specific end date (most loans fall into this category) are repaid by amortization. While your payments stay the same every month, the amount paid to the principal versus the interest changes. At the beginning of your loan, you pay more towards interest. At the end, the majority of your payment is put towards your principal. Below is an example to explain amortization more!

Non-PITI

Mortgage Insurance – Your standard PITI payment may need a boost in the early years. We’re talking about mortgage insurance. Both Private Mortgage Insurance (PMI) and the Federal Housing Administration Mortgage Insurance Premium (FHA MIP) apply here. Mortgage insurance adds an expense to your payment but it won’t last forever. PMI is necessary when you’re making a down payment of less than 20% on a conventional loan. FHA MIP comes into play for FHA loans and will eventually “fall off” if you’ve made a down payment of 10% or more. For borrowers with a down payment of less than 10%, the FHA MIP extends through the life of the loan. Some borrowers eventually choose to refinance to eliminate FHA MIP’s. If you think a refinance could lower your mortgage payment, contact a Ruoff Home Loan Specialist.

Additional Insurance – Depending on the location of your home, you may be required to purchase flood and/or earthquake insurance…or you may want to purchase it anyway. These and some other natural disasters are not covered by a typical homeowner’s policy.

Extra Principal Payments – Many homeowners choose to increase their monthly payment beyond the required minimum. For example, if your mortgage payment is $1,400 you could increase it to $1,500 each month and direct the extra $100 toward the principal. That extra payment really adds-up and will shorten your loan term and reduce the amount of interest you pay over the life of the loan. The earlier you start paying extra on the principal, the faster your benefits will grow.

A Word on Cash-out Refinances – If your existing mortgage is the result of a cash-out refinance, then the principal is likely paying for things other than the house. For example, if you used the cash to remodel your kitchen, you’re paying for the enjoyment of your new kitchen in addition to building equity in your home.

There you have it. The mortgage payment in all its detail! If you think you’re paying too much on your current loan or simply want to discuss specifics with someone who loves to talk finance, give one of Ruoff’s Loan Professionals a call. They’re always here to help!

.png?width=375&height=150&name=MicrosoftTeams-image%20(63).png)